Provides a digitised alternative to traditional interest rate hedging products.

An asset class agnostic approach

Our platform is designed to support different groups of financial securities. This asset class agnostic approach ensures the benefits generated by our tokenisation technique, smart contracts and automated lifecycle event engine can be enjoyed across many markets. Our initial asset class focus is to support VCCs and Interest Rate Derivatives.

Asset Class

A better experience

Supporting multiple asset classes in one platform creates several synergies, from broader market participation, enhanced accessibility and consolidated risk oversight, to streamlining regulatory compliance

A programmable smart contract is a series of digital contract templates, capable of autonomous functions, programmed with commercial, legal and operational logic to undertake an obligation.

Tokenovate’s digital asset solutions are pre-built programmable lifecycle contracts ready for use by legal, finance, compliance and trading teams to represent your hedging and risk requirements.

Tokenovate’s digital asset solutions are pre-built programmable lifecycle contracts ready for use by legal, finance, compliance and trading teams to represent your hedging and risk requirements.

and reducing complexity and operational costs. It also facilitates innovation, and makes it easier to adapt to new asset classes as they emerge without requiring changes to the underlying infrastructure.

Voluntary Carbon Credits

Trading Voluntary Carbon Credits (VCC’s) is a recognised mechanism that allows individuals and companies to invest in environmental projects that contribute to reducing the amount of CO₂ in the atmosphere.

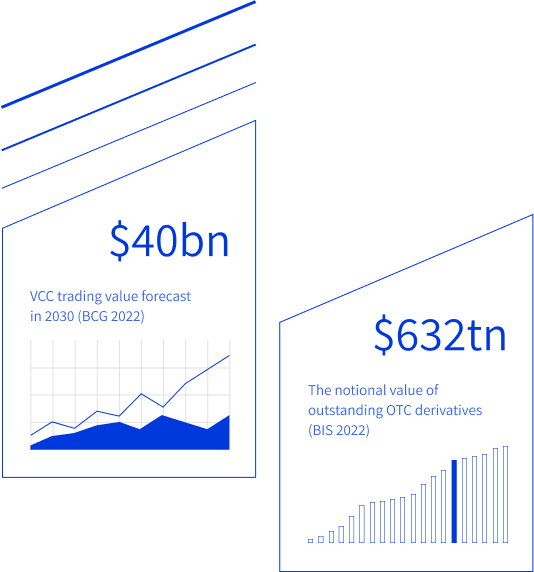

And the market potential is huge: Bloomberg NEF (2023) believes the Voluntary Carbon Credit market could reach $1 trillion by 2037.

And the market potential is huge: Bloomberg NEF (2023) believes the Voluntary Carbon Credit market could reach $1 trillion by 2037.

1.

Environmental

Improve livelihoods and biodiversity, clean water and air quality while balancing carbon footprints.2.

Reliable

Support for both voluntary and compliance markets.3.

Efficient

Access a selection of products, from spot to forwards.

Interest Rate Derivatives

Interest Rate Derivatives (IRDs) are financial instruments widely used for hedging or speculating on the movement of interest rates. Our aim is to modernise IRDs by standardising and digitising them, thereby creating an accurate representation of the underlying contract. In doing so, we will automate calculations, trade processing, give-up to clearing and trade reporting, thus simplifying lifecycle management, reducing overall costs and operational inefficiencies.

Contact us

Get in touch

Want to get in touch? We’d love to hear from you. To receive more information, or talk to us about how we can help you, please provide us with your contact details.