Increase liquidity of traditionally illiquid assets.

The digital assets opportunity

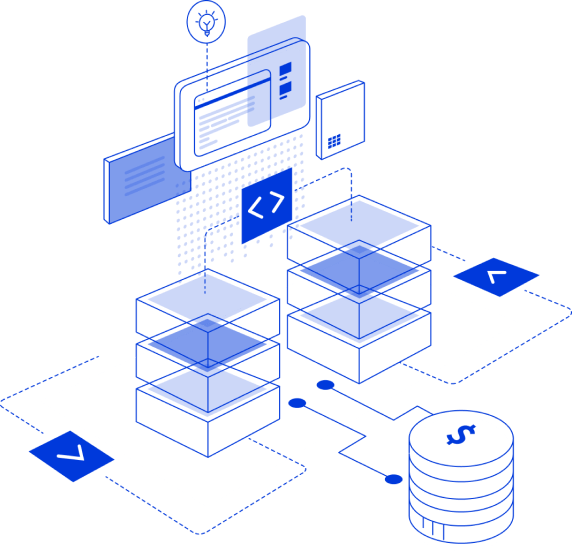

A digital asset refers to any asset that is created, traded and stored in a digital format. That format is often captured in a token or smart contract. Tokenised assets enjoy several benefits: from enhanced security and transparency to increased mobility and traceability.

Digital Assets

Digitising and tokenising derivatives

The market for tokenisation and digital assets is expected to explode in the coming years. BCG thinks it can be worth up to $16 trillion in 2030. Much of that will be traded under ISDAs proven definitions and contractual framework. Tokenovate’s platform is designed to digitise

A programmable smart contract is a series of digital contract templates, capable of autonomous functions, programmed with commercial, legal and operational logic to undertake an obligation.

Tokenovate’s digital asset solutions are pre-built programmable lifecycle contracts ready for use by legal, finance, compliance and trading teams to represent your hedging and risk requirements.

Tokenovate’s digital asset solutions are pre-built programmable lifecycle contracts ready for use by legal, finance, compliance and trading teams to represent your hedging and risk requirements.

and tokenise ISDA derivatives and create smart contracts that automates contractual obligations and transforms operational efficiencies, driving significant cost savings in collateral and settlement management.

Token types

Digital assets are typically tokenised in one of three different structures, each with different legal, security and operational contexts. Tokenovate supports the creation of tokens in each of these formats:

- 1.

Bearer Tokens

Ownership is decided by who has control. - 2.

Registered Tokens

Ownership is managed through the blockchain. - 3.

Claims Token

Ownership is decided in a contractual agreement.

Real-world assets

Creating digital representations of physical assets, such as real estate or commodities, facilitates the fractionalisation of RWAs. This not only enables their use as collateral but also allows for efficient digital trading. These tokens, or “digital twins”, enhance processing efficiency, increase liquidity and improve accessibility compared to traditional physical assets.

Contact us

Get in touch

Want to get in touch? We’d love to hear from you. To receive more information, or talk to us about how we can help you, please provide us with your contact details.