Imagine a situation where information is instant and access is ubiquitous. In a business scenario, the potential to create value by increasing efficiency, introducing better decision-making and ultimately solving hard problems would be vastly improved.

Now look at the current state of financial settlements, often referred to as T+2. The T+2 cycle refers to the time it takes from a trade (T) taking place to the time in days it takes before the transaction is settled (+2). This delay in settlement is both costly and introduces many challenges. For example, there is still much manual work involved in this process, from mid to back offices, to highly fragmented infrastructure set-ups.

In this informative news clip, Tanaya Macheel at CNBC digs deeper into the T+2 challenge by looking at how the Blockchain can help a move towards T+0. The clip also points to research by AB Bernstein that highlights the attractive market opportunity in tokenising digital assets and simplifying how that is done.

Tokenisation of assets, of course, isn’t a new thing. In fact, we’ve been doing it for hundreds of years. And the concept of a cash-ledger is even older. So, at its core, we are not dealing with anything new.

But with the accelerated pace of digitisation, the standardisation and collaboration between market actors have lagged behind. This disconnect has resulted in many gaps throughout the financial system, as well as highly siloed infrastructures, where money moves on one set of rails, and assets on another.

Umar Farooq, CEO of Onyx by JP Morgan, hits the head on the nail when he says that collapsing siloed infrastructures into one global infrastructure have the potential to put both money and assets on the same rail, thus making it possible to streamline processes, achieve efficiencies and reduce time to settlement. His views are echoed by many, including Larry Fink of Blackrock, but he adds that the blockchain is probably not suitable for all variants of trading.

That said, the tokenisation of digital assets still represents an enormous business opportunity. Several recent research notes point to a $5tn market in a few years. Citi GPS in March this year “forecast $4 trillion to $5 trillion of tokenized digital securities and $1 trillion of distributed ledger technology (DLT)-based trade finance volumes by 2030”, and AB Bernstein stated in a primer released in June that they “forecast ~5tn of real-world financial assets will be tokenized on blockchains over the next five years”.

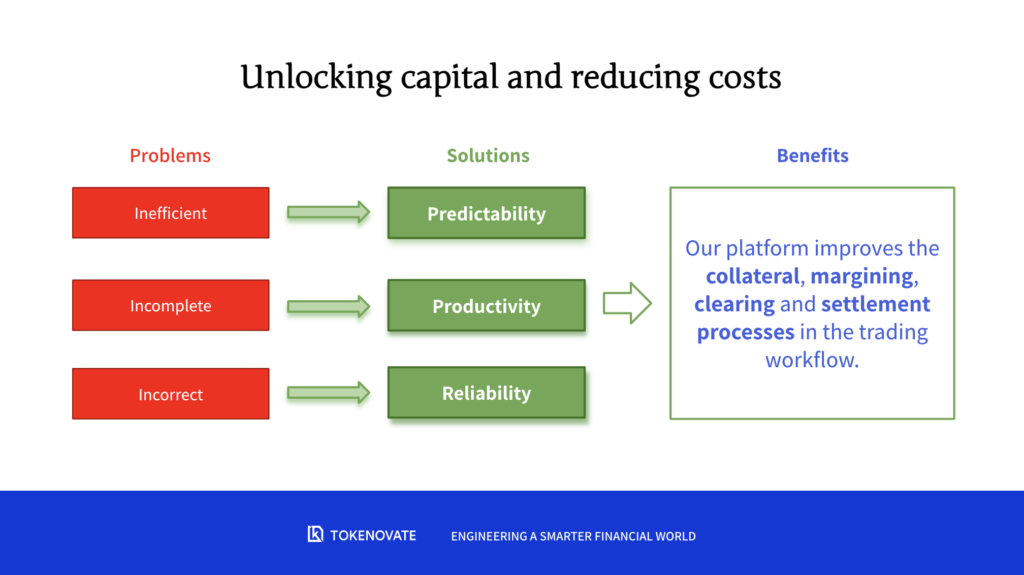

The vision of Tokenovate – among other things – is to solve the challenge of T+2 and turn this opportunity into reality. Our distributed market financial infrastructure (dMFI) platform can support the unlocking of capital that creates value in the derivatives trading lifecycle, all while improving efficiency and increasing quality through our unique smart legal contracts solution.

Interested in learning more? Feel free to get in touch.